Money Makeover: How Lisa Marie Curbed Extra Spending with ELGA Credit Union

When I started my financial make-over with ELGA Credit Union, I knew I was in for a “workout.” For me, hitting the gym seemed easier than changing my spending habits. Change is hard, but change is also very good. Fast forward a few months, and I will be the first to stand up and say this is the best thing I ever did for myself and my future.

When I started taking a good look at my spending habits, I was amazed by how quick I was to just spend without thinking. I literally was the poster child for impulse buying. “See it, love it, swipe it and buy it!”

That seemed to be my motto for life. My financial coach told me to start small with analyzing my spending and creating a budget. Guilty pleasure indulgences like Starbucks weren’t completely omitted, but curbed. I went from an average of $55 a week on Starbucks to a budget of just $20. I thought it was going to be impossible, but you know what? I find myself spending under $20 now and enjoying a morning coffee at home instead.

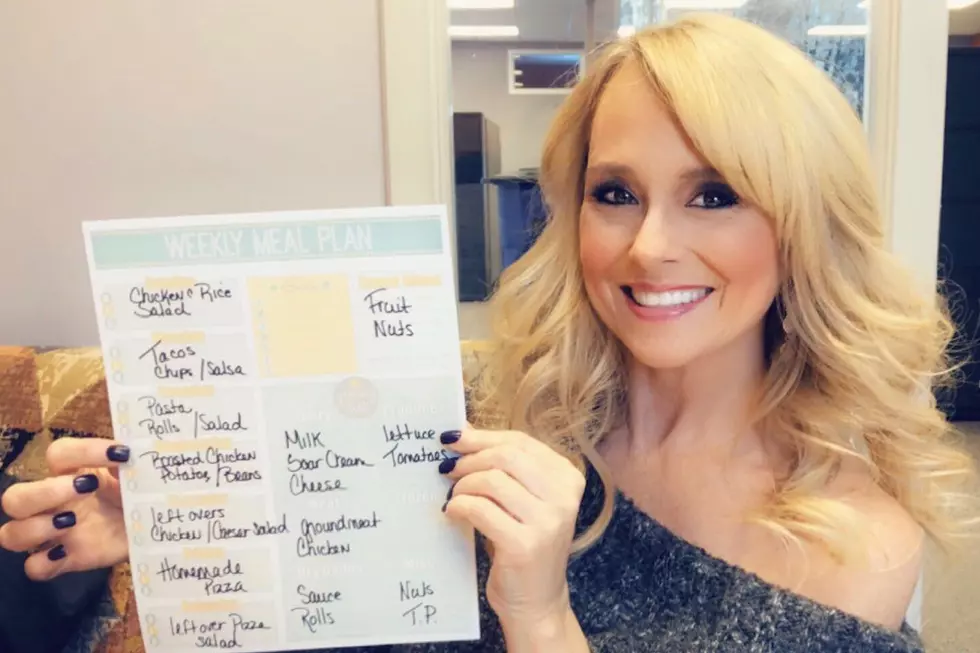

Grocery shopping was another spending habit that needed to be controlled. With a daughter away at school, I found myself throwing a lot of food away. I didn’t plan ahead and was still shopping like there were two of us to feed. During one of my Financial Fitness classes at ELGA (they are free and held on all types of subjects), I discovered the wonderful world of meal calendars.

I plan out a whole month of dinners and when I head to the grocery store with a list in hand, I know exactly what to buy. Then, I don’t end up with 10 packs of pasta in the pantry because I thought I needed more. With a structured budget in mind and using cash instead of a card, I have continued to save money.

Now I know all of this may look fine, but if you’re like me, you love to see proof that all the effort isn’t in vain. I received proof in the way of a credit score that’s finally going up.

I started my journey with a new budget, a consolidation loan to pay off my debt, and saying “bye-bye” to credit card living. Now, just under 2 months into my journey, my credit score has gone up by 40 points. 40 Points! For the first time in a long time, I’m not counting down minutes until payday. I know exactly what I have to work with paycheck to paycheck, and it’s simplifying my life in ways I never knew.

The holiday season is upon us and I am thrilled to be taking it on without the financial stress. I’m learning to plan and save the ELGA way, and financial freedom is becoming a closer reality than this girl ever thought possible.

Why not take hold of your spending? Start your own financial makeover today with ELGA Credit Union! Visit an ELGA branch near you or ELGACU.com to get started.