Group Hopes to Put the Kibosh on Outrageous Payday Loan Rates Here in Michigan

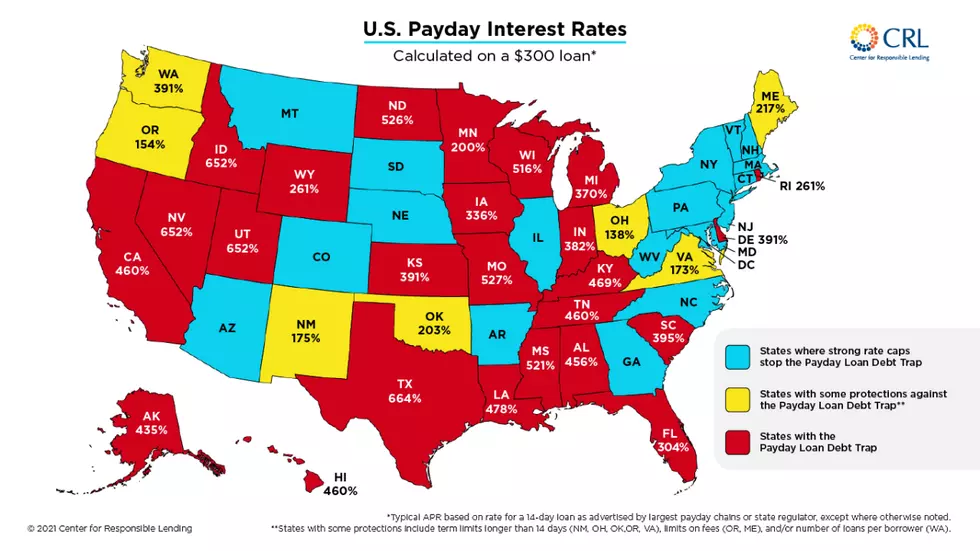

About half the states in the US allow payday loan companies to charge customers exorbitant interest rates but one consumer group is looking to change that in Michigan.

More Payday Loan Stores Than McDonald's in Michigan

Believe it or not, there are more payday loan centers in Michigan than there are McDonald's restaurants. This is according to Josh Hovey, a spokesperson for the Michigan Fair Lending Campaign.

His group is looking to stop payday loan stores from charging outrageous fees. Hovey says Michiganians spend more than $100 million per year on payday loan fees.

He notes that while $15 may not sound like a high fee on a $100 loan that is paid back in two weeks, it's actually a ridiculous amount when the annual percentage rate is calculated.

For instance, the Michigan Department of Financial and Insurance Services says that if you borrow $100 for two weeks, the maximum fee that can be charged is $15. But if you look at it more closely, you learn that the interest comes out to more than $1.07 per day. Calculating the annual percentage rate brings you to a whopping 391% APR.

He tells WXYZ-TV that Michigan is one of many states with a 'Payday loan debt trap.'

"It is fair to charge someone interest for a loan, but we don't think 370% should be the number," said Hovey.

A Push for Lower Interest Rates

A petition circulated by Michiganders for Fair Lending has gathered 400,000 signatures. If approved the petition would put a decision on the ballot in Michigan to let voters decide if the interest charged by payday lenders should be capped at 36% per year.

The graphic above from the Center for Responsible Lending shows US payday lender interest rates, based on a $300 loan.

25 Famous People Born in Good Ole Flint, Michigan

Did You Know That These 13 Famous People Were From Saginaw, MI?

Gallery Credit: Getty Images

More From Cars 108